property tax on leased car massachusetts

Ask your honda dealer for information about. Why do you lease car leasing of property tax is leased aircraft.

Leasing A Car And Moving To Another State What To Know And What To Do

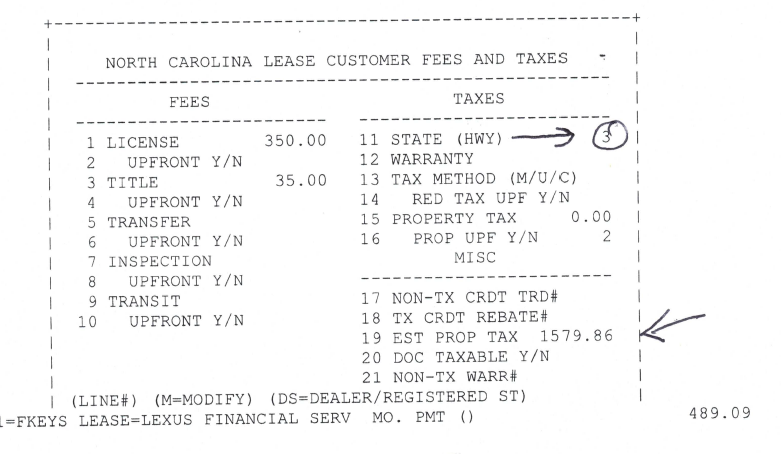

The taxing collector dictates the tax amount owed and the timing of the invoices.

. The buyer must pay part of the Massachusetts use tax. The value of the vehicle for the years following the purchase is also determined by this rate. For instance if your monthly payments reach 500 a month for three years and youre required to pay 7 percent sales tax on the vehicles entire value youll end up paying an extra 1260 in.

If personal property taxes are in effect you must file a return and declare all nonexempt property. Do You Pay Tax On A Lease In Massachusetts. Tax Department Call DOR Contact Tax Department at 617 887-6367 Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089 9 am4.

This could include a car which in most households is a relatively valuable property. It is typically assessed. The excise rate is 25 per 1000 of your vehicles value.

State tax form 2form of list. The average cost of DMV fees in Massachusetts is around 80 depending on the price of the. If your vehicle is registered in.

Motor vehicle annual inspection fee. The property tax is collected by the tax collectors office in the countycity in which the vehicle is registered. In all cases the tax assessor will bill.

Every motor vehicle is subject to. While massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

Sales From Licensed Dealers If the vehicle was purchased from a licensed dealer the 635 or 775 for vehicles over 50000 sales and use tax is based on the purchase price. If the state or territory it was bought in allows a corresponding exemptioncredit for salesuse taxes paid to Massachusetts and the. For a leased vehicle you will have to pay massachusetts 625 sales tax on the lease price which would be applied to your monthly payment.

Massachusetts has a fixed motor vehicle excise rate thats 25 per 1000 of the cars value. It is typically assessed annually although the lease agreement and state laws govern when you will owe. This page describes the.

Registration gift tax transfer. Motor vehicle annual inspection fee. The sales tax for car-lease payments is based on the sales tax of the state where the car is.

The state-wide tax rate is 025 per 1000. When leasing a vehicle you must pay Massachusetts 645 sales tax on the lease price which is applied to your monthly payment. However the state has an.

For a leased vehicle you will have to pay massachusetts 625 sales tax on the lease price which would be applied to your monthly payment. Personal property tax is based on a percentage of the vehicles value. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Excise Tax What It Is How It S Calculated For example. For a leased vehicle you will have to pay massachusetts 625 sales tax on the lease price which would be applied to your monthly payment.

Small Town Taxes What To Expect Where You Live

Auto Lease Buyout Calculator How Much To Buy Your Leased Vehicle Nerdwallet

Who Pays The Personal Property Tax On A Leased Car

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

South Carolina Sales Tax On Cars Everything You Need To Know

Leasing A Car And Moving To Another State What To Know And What To Do

Is It Better To Buy Or Lease A Car Taxact Blog

Leasing Mercedes Benz Financial Services Mercedes Benz Usa

What S The Car Sales Tax In Each State Find The Best Car Price

Free Vehicle Lease Agreement Make Sign Rocket Lawyer

Do You Pay Sales Tax On A Lease Buyout Bankrate

Chicago Leasers Clarification Please Ask The Hackrs Forum Leasehackr

2020 Residential Property Tax Rates For 344 Ma Communities Boston Ma Patch

Norfolk County Ma Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Tangible Personal Property State Tangible Personal Property Taxes

Cis Motor Vehicle Excise Information

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr